"Mastering your emotions doesn’t mean you don’t feel them; it means they no longer control your actions."

Hello, my friends!

Today, the markets were hit hard with a relentless flush, leaving little room for buyers to stage any kind of meaningful recovery.

Major indices across the board closed in deep red, making it feel like a sea of losses.

The only glimmer of green came from the USD forex pairs, holding strong while everything else sank.

But here's the real question!

How do you handle days like this without letting fear, greed, or frustration take control?

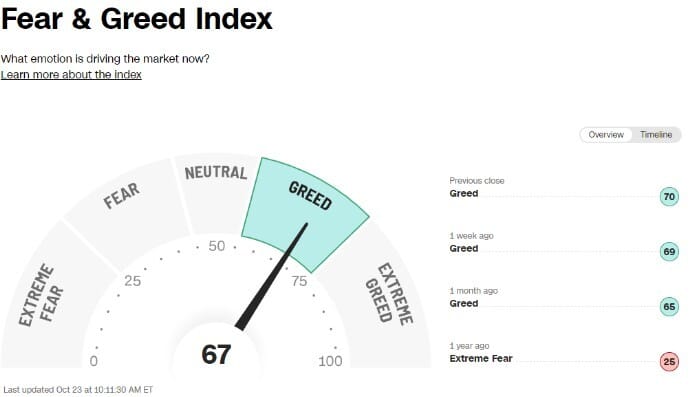

Sentiment Lowered to 67

This is exactly when emotional mastery becomes the game-changer that separates the pros from the amateurs.

On days like today, when panic is in the air and emotions run high, it's easy to fall into the trap of impulsive decisions.

Now’s the perfect time to dive into how to conquer these three emotional hurdles: fear, greed and frustration.

Lessons from the Trenches 📚🧠

Fear is the emotion that holds you back from making the bold moves you know are necessary. Fear of losing, fear of missing out, fear of being wrong - these are all paralyzing if left unchecked.

How to Overcome:

Embrace Risk: Every professional trader has taken losses. The key is to minimize those losses with proper risk management and learn from them.

Plan Before You Trade: Enter each trade with a defined plan - know your entry, exit, and stop-loss levels. This structure leaves less room for fear to creep in.

Visualize Success: Start your trading day with a visualization of executing your trades confidently. By imagining success, you trick your mind into lowering the grip of fear.

Greed can be tricky - it often disguises itself as ambition or a thirst for profit. But when left unchecked, greed leads to overtrading, holding onto positions longer than necessary.

How to Manage Greed:

Set Profit Targets: Before entering a trade, decide on a realistic profit target and stick to it. Knowing when to take profits is just as important as knowing when to cut losses.

Keep a Journal: Document every trade, including your thought process. This helps you recognize patterns of greed and impulsiveness, allowing you to adjust in real-time.

Stay Detached: Don’t let winning streaks inflate your ego. Approach every trade as if it’s your first—focused and without emotional baggage from previous wins or losses.

Frustration comes when things don’t go your way - whether it’s a streak of losses or missing out on a great trade. It clouds your judgment and often leads to revenge trading.

How to Deal with Frustration:

Take Breaks: When frustration sets in, step away from your screen. Taking a break can clear your mind and help you return with a fresh perspective.

Focus on Process, Not Results: Instead of fixating on a winning trade, concentrate on executing your strategy perfectly.

Reframe Losses as Lessons: Every loss holds valuable insights. Instead of letting frustration take over, ask yourself: What can I learn from this?

Adopting this mindset turns losses into stepping stones for future success.

NY Impulse: Nasdaq (-1.12%)🗽📉

U.S. Futures Slip as Treasury Yields Surge Amid Fed Uncertainty

Investors Brace for Boeing, Coca-Cola, and Tesla Earnings

Starbucks Falls 5.2% After Suspending Annual Forecast

Texas Instruments Jumps 4% After Q3 Profit Beat

Rising Yields and Upcoming U.S. Elections Could Test Market Rally

Fed Officials and Home Sales Data in Focus as Markets Weigh Next Steps

NQ 20,550 (0DTE Highest Level of Call Gamma)

NQ 20,490 (0DTE Positive/Negative Shift)

NQ 20,296 (1 Day min - Extreme Range)

0DTE Levels are key zones of significant options volume that can drive increased volatility as expiration nears, recalculated daily based on gamma expiration, trading volume, and market volatility.

Interested in learning how I manage key levels in the market? Join the community!

Emotional mastery is the key to longevity in the markets.

When you tame fear, manage greed, and keep frustration in check, you’ll find yourself making clearer, more confident decisions.

The most successful traders aren’t those with the highest IQs - they are the ones who’ve learned how to master their emotions and stick to their strategy, no matter what the market throws at them.

Until next time,

Steve B

Founder, The Daily Impulse

We Value Your Feedback!

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices.

Third-party websites are for your convenience and informational purposes only. Please note that we have no control over the content, policies, or practices of any third-party sites. We recommend reviewing the terms and privacy policies of any third-party sites you visit.