Hello, my Friends!

In today’s session, we’re diving into one overlooked hedging tool in the financial world - the VIX.

Known as “The Fear Index,” the VIX isn’t just an instrument; it’s the heartbeat of market sentiment.

Here’s why it matters:

Institutions rely on the VIX as a crucial hedge tool to gauge risk and volatility.

News outlets report on tariff delays and other policy moves, which push markets into a “risk-on” mode.

The VIX Unveiled:

Record Highs:

During the 2008 financial crisis, the VIX soared above 80, and in March 2020, amid pandemic uncertainty, it surged to similar extremes.Average Calm:

In more tranquil times, the VIX typically drifts in the low to mid-20s, reflecting stable investor sentiment and subdued volatility.Evolution and Innovation:

Originally launched by the Chicago Board Options Exchange (CBOE), the VIX has continuously evolved. Its refined calculation methods now offer an even more precise measure of short-term market expectations.

The trading session signaled potential market reversals, as volatility metrics aligned with significant headlines.

Greed Reversal

Here were some of the headline-grabbers:

US Commerce Secretary Lutnick: “Tariff reprieve not likely just about auto makers - likely to include all USMCA-covered products.”

“I expect to speak with Mexican counterparties later today.” (CNBC)

Canada’s PM Trudeau: “We’re in discussions on possibly delaying the second wave of our planned tariffs.”

US Commerce Secretary Lutnick: “My expectation is that April 2nd reciprocal tariff rates start high, and then start coming down.”

These rapid-fire updates aren’t mere background noise; they are the catalysts that drive the market Impulses we track day in and day out.

Its real-time pulse on investor fear and confidence not only guides hedging strategies but also serves as a critical predictor in financial research. Knowledge is your best hedge!

Partners

Ready to discover the ultimate journaling software?

Click here for free trial and if TraderSync meets your journaling needs, unlock 15% off with code: tdi

Are you curious to see the charts in action?

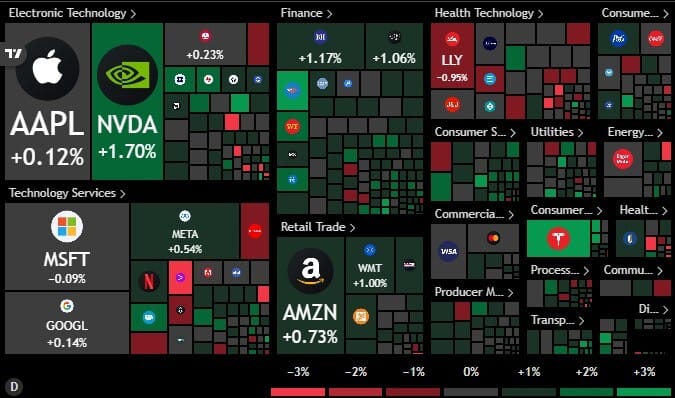

Click the heatmap below for your exclusive invitation to Trading-View - and enjoy extra benefits along the way!

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

Until next time,

Steve B

Founder, The Daily Impulse

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices.

Third-party websites are for your convenience and informational purposes only. Please note that we have no control over the content, policies, or practices of any third-party sites. We recommend reviewing the terms and privacy policies of any third-party sites you visit.