Hello, my friends!

Starting this Friday, we shift to a weekly edition - packed letter that delivers:

Mindset Reset: actionable psychology to finish the week strong.

Market Recap: the week’s pivotal moves, distilled and decisive.

Between updates, catch our Daily Impulse Shorts on YouTube very soon!

It will include bite‑sized videos that spotlight each day’s biggest headlines and the chart action behind them.

Tuesday opened with an upside surprise in Big Tech, snapping Monday’s deep sell‑off that had many braced for another leg lower.

The first catalyst? A headline blitz from President Trump aimed squarely at Fed Chair Jerome Powell:

Trump: There can be a SLOWING of the economy unless Mr. Too Late, a major loser, lowers interest rates, NOW - Truth Social Post

Preemtive cuts in rates being called for by many.

Trump calls on Powell to lower interest rates.

Nasdaq V Shape

🔄 Bears doubled down until close - but within 24 hours the tape staged a textbook V‑shape reversal, driving the Nasdaq above its last impulse high and squeezing short‑side traders into the close.

🎢 Once again, a day‑trader’s playground - yet a swing‑trader’s nightmare.

😨 Fear still looms: global‑growth downgrades + White House vs. Powell tension.

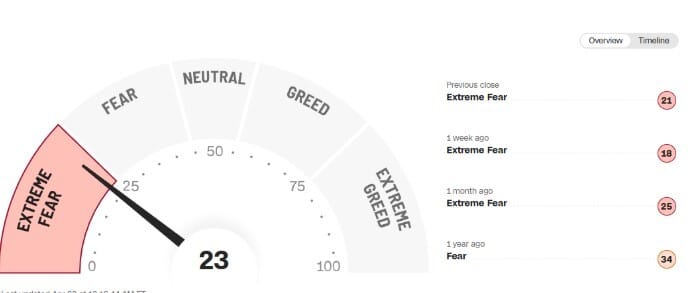

The Fear & Greed Index - parked in Extreme Fear - is starting to edge higher, hinting at stored fuel for another squeeze.

Fear & Greed Index

The Fear & Greed Index distills seven market‑behaviour gauges into a single 0‑100 score.

Here’s how its measured:

Market momentum – compares the S&P 500 to its 125‑day moving average → gauges overall trend strength

Stock‑price strength – tracks NYSE 52‑week highs vs. lows → shows breadth of breakouts or breakdowns

Stock‑price breadth – measures advancing vs. declining volume on the NYSE → reveals depth of market participation

Put/Call options – looks at the 5‑day average equity put/call ratio → indicates hedging pressure vs. speculation

Volatility – contrasts the CBOE VIX with its 50‑day moving average → reflects the fear premium priced into options

Safe‑haven demand – compares 20‑day returns of Treasuries to stocks → signals flight‑to‑quality flows

Junk‑bond demand – examines the spread between Baa corporates and the 10‑year Treasury → measures risk appetite in credit markets

The current condition in extreme‑fear can often stretch and precede outsized forward returns; while extreme‑greed tends bursts burn out quickly.

Historical Headlines:

Date (close) | F&G reading | Market backdrop |

|---|---|---|

Aug 8 2011 | 12 | U.S. debt‑ceiling downgrade & Euro‑area crisis |

Dec 24 2018 | 5 | Fed hiking cycle worries & “Christmas‑Eve crash” |

Mar 12 2020 | 2 | Covid‑19 global sell‑off, S&P ‑9.5 % day |

Nov 8 2021 | 92 | Post‑vaccine reopening melt‑up, Mag‑7 mania |

Oct 13 2022 | 15 | CPI shock; S&P hits bear‑market low |

Apr 4 2025 | 4 | Tariff flare‑up drives Dow ‑2,200 pts |

Treat the index as a dashboard warning light, not a steering wheel. Acknowledge it, adjust speed, but let price action and your risk plan steer the course.

Market Rundown

Tesla’s Earnings

Tesla Q1 Profit Plunges 71% as Musk’s Washington Role, Trade Tariffs Bite

Missed EPS, Slowing EV Demand: Tesla Warns Tariff Turbulence May Force Sales Rethink

Musk Cuts Back on Federal “Cost‑Cutting Czar” Duties; Defends Fight Against Waste

Revenue Falls 9%, Auto Sales ‑20%, but Energy & Software Units Post Double‑Digit Growth

Investors Sigh in Relief - Affordable Models, Robotaxi Launch Keep Shares Green After Hours

Tariff Regime, Brand Backlash Slam Tesla Deliveries in U.S., China, Germany

Operating Margin Craters to 2.1%; AI Spend, Model Y Re‑tooling Drag Bottom Line

📔 Ready to discover the ultimate journaling software? Click here for free trial and if TraderSync meets your journaling needs, unlock 15% off with code: tdi

🌐 Interested in boosting your output by 2-3X? Enjoy 3 free sessions per week as a sneak peek before stepping up to FocusMate Plus. Click here to get started!

Elon Dreams, Mode Mobile Delivers

As Elon Musk said, “Apple used to really bring out products that would blow people’s minds.”

Thankfully, a new smartphone company is stepping up to deliver the mind-blowing moments we've been missing.

Turning smartphones from an expense into an income stream, Mode has helped users earn an eye-popping $325M+ and seen an astonishing 32,481% revenue growth rate over three years.

They’ve just been granted the stock ticker $MODE by the Nasdaq—and the share price changes soon.

*An intent to IPO is no guarantee that an actual IPO will occur. Please read the offering circular and related risks at invest.modemobile.com.

*The Deloitte rankings are based on submitted applications and public company database research.

I’d love to hear about your entrepreneurial journey - just hit “reply” to this email to share your story!

And let’s keep the conversation going on X.

Until next time,

Steve B

Founder, The Daily Impulse

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices.

Third-party websites are for your convenience and informational purposes only. Please note that we have no control over the content, policies, or practices of any third-party sites. We recommend reviewing the terms and privacy policies of any third-party sites you visit.