“Trust the process. Your time is coming. Just do the work and the results will handle themselves.”

Hello, my friends!

In the electrifying arena of today's markets, turbulence reigns supreme.

Volatility is increasing on Wall Street, with labor data signaling a cooldown and Bitcoin plunging to new lows below $100,000 USD.

Bitcoin

It's a high-stakes storm that tests even the coolest of traders. Yet, amid this whirlwind, my intraday mindset remains unchanged - a fortress that no market frenzy can breach.

The Objective:

To tame those fleeting daily impulses and forge ahead toward unwavering trading capital growth.

Maintain the established risk management perimeters.

Having spotlighted my payouts from Prop Firms - across my X account (@Libra_Trading) - now is the pivotal moment to unveil my mindset and reveal how to strategize these rewards to the next level.

Stay tuned as we dive deeper into turning volatility into victory.

Lessons From The Trenches

Proprietary trading firm payouts are well-deserved rewards for consistent, disciplined performance. However, mismanaging these funds - such as through unnecessary spending on luxury items or unrelated indulgences - can impede long-term success.

Instead, allocate them strategically to drive growth, with a focus on scaling capital, enhancing mindset, and optimizing your trading environment.

Avoiding Common Pitfalls

Treat payouts not as disposable income, but as capital for reinvestment.

Impulsive spending undermines financial stability and maintains reliance on firm challenges.

Adopting a structured allocation model, such as the 50/30/20 rule (50% toward scaling, 30% toward personal development, and 20% toward office essentials), fosters compounding growth and promotes financial independence.

Scaling Capital Effectively

Reinvest payouts to expand your trading capabilities

Establish a drawdown reserve to manage risks and strengthen future negotiations.

Diversify across multiple firms to mitigate platform-specific risks and improve adaptability.

This methodical approach can transform initial earnings into a robust, diversified portfolio.

Enhancing Mindset and Tools

Trading excellence relies on mental resilience.

Allocate resources to - Educational materials, coaching, and books (e.g., Trading in the Zone) to sharpen decision-making.

Journaling applications and biofeedback tools for monitoring emotions and maintaining focus.

Private communities for accountability, networking, and strategy exchange.

These investments reduce errors and enhance overall consistency.

By prioritizing these key areas, traders can convert payouts into a lasting process. Implement and regularly review these strategies to unlock your full potential.

🤝 Let's connect!

Share your insights on managing daily impulses in the poll below. We all encounter challenging moments during our workdays.

⚡Which of the following would you find most helpful for managing your daily impulses?

Progress Update

Lucid Trading Account

I have successfully progressed to Level 2 of the Straight-to-Funded program.

The initial payout target of $9,000 has been achieved, with $3,000 deducted as a management / trading fee.

This milestone was reached within one month while trading a single account. This structure has strengthened my mental framework, allowing me to lower overall risk exposure leading into level 2 of the process.

Traders often fall into the trap of rushing forward, even after securing their first payout. The essential strategy is to build a sufficient buffer, ensuring that inevitable losses do not derail your progress.

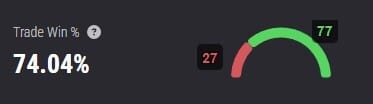

As illustrated, my trade win rate stands at 74%. While perfection in trade is unattainable, the focus remains on swiftly cutting losses as trends begin to reverse.

Remain flexible and prepared to adjust your plan when market conditions demand it.

Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.

What’s your trading story?

Hit reply and join the community waitlist!

Until next time,

Steve B

Founder, The Daily Impulse

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. I am not a registered investment advisor, broker, or licensed financial professional. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices. Trading and investing involve significant risks, including the potential for substantial financial loss.

Some content, including advertisements, promotions, or links, may be sponsored or part of affiliate programs (such as with proprietary trading firms). I may receive compensation, commissions, or other benefits if you click on affiliate links, sign up for services, or make purchases through them. These relationships do not necessarily imply endorsement, and all opinions expressed are my own unless stated otherwise. Potential conflicts of interest may exist due to these partnerships.

Past performance or examples discussed are not indicative of future results. I do not guarantee the accuracy, completeness, or timeliness of the information provided, and I disclaim any liability for errors, omissions, or any losses incurred as a result of using this content.

Third-party websites are for your convenience and informational purposes only. Please note that we have no control over the content, policies, or practices of any third-party sites. We recommend reviewing the terms and privacy policies of any third-party sites you visit. By subscribing or reading this newsletter, you agree that you will not hold me or any associated parties responsible for any actions you take based on its content.