Hello, my friends!

🧩 Many investors are puzzled by the recent surge in global market volatility driven by U.S. actions.

Here's a quick breakdown to help you understand exactly what's happening - and why:

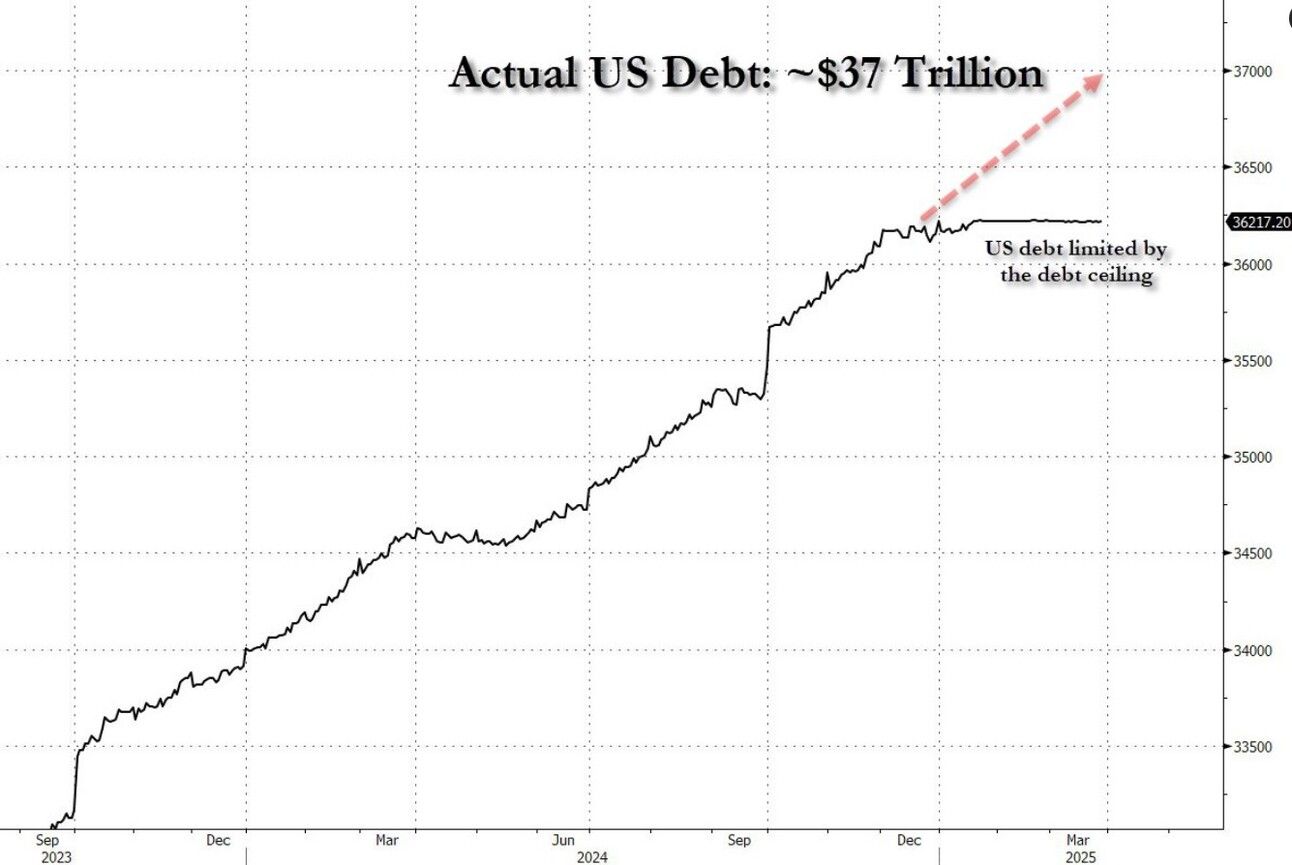

U.S. debt stands at a staggering $37 trillion, an unprecedented level.

By 2025, the government faces a critical task: refinancing a massive $9 trillion of this debt.

To manage this, they've aggressively cut spending and ramped up productivity, aiming to reduce the annual deficit from roughly $2 trillion down to zero, curbing inflation in the process.

Heightened fear in the markets drives investors toward bonds. As demand for bonds increases, yields drop.

Lower yields mean refinancing the massive debt load becomes significantly cheaper.

🚀 This week, the markets find themselves in a familiar position: a sharp pre-market sell-off followed by an explosive push higher in major assets.

🧱 Is this finally the true bottom, paving the way for a sustained bullish trend, or are we witnessing another deceptive bear market rally poised to plunge back into the abyss?

🧠 In times like these, forward-thinking is essential. It’s crucial to stay vigilant about major upcoming events capable of shifting market sentiment and liquidity rapidly.

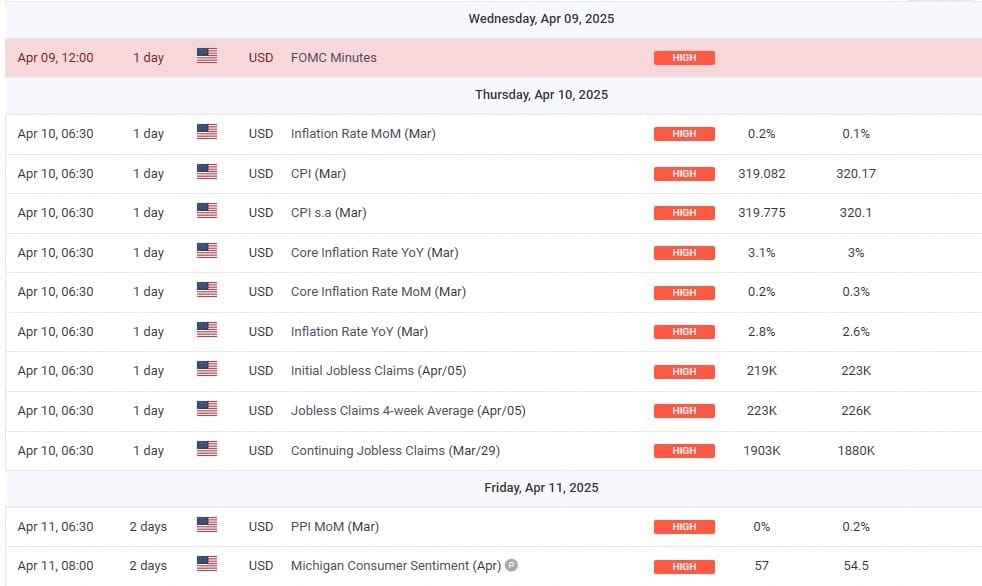

Here are the headline events driving today’s volatility:

U.S. Trade Representative Greer announced significant reciprocal tariffs going into effect tomorrow.

China remains silent on reciprocal negotiations, signaling unresolved tension.

Pharmaceuticals and Semiconductors have been excluded from tariffs for further investigation - a critical industry detail.

Fed’s Goolsbee warned tariffs have proven significantly larger than anticipated, jolting market sentiment.

Dramatic sentiment shifts are becoming the norm, and as disciplined market participants, it's our responsibility to zero in on crucial data and filter out distractions.

Nasdaq’s Impulse

Will Monday’s low hold firm as the temporary bottom, or will the upcoming FOMC meeting minutes amplify the bearish sentiment, keeping buyers hesitant?

Stay alert and manage risk proactively - this week’s events could reshape the trading landscape entirely.

Today, markets experienced a notable midday reversal triggered by China's rejection of reciprocal tariff negotiations.

Here's your complete end-of-day market rundown:

U.S. Markets Slide:

Nasdaq down 2.2% (15,267.9), S&P 500 off 1.6% (4,982.8), and Dow slipping 0.8% (37,645.6) after a fizzled pre-market rally.Tariff Shock:

The Trump administration is set to implement additional 50% tariffs on China - raising the total to 104% - igniting further market turbulence.Global Trade Tensions:

China vows to "fight to the end" in response to the U.S. tariff announcement, deepening trade friction.Rising Yields:

U.S. Treasury yields edge higher with the 10-year at 4.29% and the 2-year at 3.75%.Small Business Woes:

Small business optimism took a hit in March as expectations on sales growth cooled amid new policy uncertainties.Oil Price Dip:

West Texas Intermediate crude dropped 3.7% to $58.46 per barrel, falling below $60 for the first time since February 2021.Tech Under Scrutiny:

EU antitrust probes into Apple and Meta stir investor nerves; Apple’s shares tumble 5%, while Meta falls 1.1%.Precious Metals Up:

Gold edged up 0.6% to $2,991.90 per troy ounce, and silver climbed 0.3% to $29.68 per ounce.

Red Calendar Events

📔 Ready to discover the ultimate journaling software? Click here for free trial and if TraderSync meets your journaling needs, unlock 15% off with code: tdi

🌐 Interested in boosting your output by 2-3X? Enjoy 3 free sessions per week as a sneak peek before stepping up to FocusMate Plus. Click here to get started!

Prevent coupon abuse, protect your profits

KeepCart: Coupon Protection partners with D2C brands like Quince, Blueland, Vessi and more to stop/monitor coupon leaks to sites/extensions like Honey, CapitalOne, RetailMeNot, and more to boost your DTC margins

Overpaid commissions to affiliates and influencers add up fast - Get rid of the headache and revenue losses with KeepCart.

I’d love to hear about your entrepreneurial journey - just hit “reply” to this email to share your story!

And let’s keep the conversation going on X.

Until next time,

Steve B

Founder, The Daily Impulse

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices.

Third-party websites are for your convenience and informational purposes only. Please note that we have no control over the content, policies, or practices of any third-party sites. We recommend reviewing the terms and privacy policies of any third-party sites you visit.