"In the early hours of a rapid market, speed can spark excitement, but discipline turns that momentum into opportunity."

Hello, my friends!

What a dramatic reversal we've witnessed today!

Across the board, major indices, tech stocks, commodities, metals, and even crypto surged into the green.

After yesterday’s sharp rate cut and the end-of-day selloff, it looked like the market might be headed lower. But the new day had other plans. The S&P 500 is now pushing toward all-time highs once again.

This was a classic Squeeze, with much of the volume driven by the options market.

Dealers were forced to hedge, and we saw a complete reversal from the FOMC-induced bottoming selloff.

Here’s a closer look into the true mechanics of a major gamma squeeze, here’s what we uncover:

Market makers need to hedge their risk. To do this, they buy the underlying stock.

The closer the stock gets to the option's strike price, the more stock the market makers need to buy to stay balanced.

As the stock price rises, this hedging process creates a feedback loop—market makers buy more stock, which pushes the price higher, forcing them to buy even more.

This relentless buying pressure is what drives the price up rapidly, often resulting in what we call a gamma squeeze.

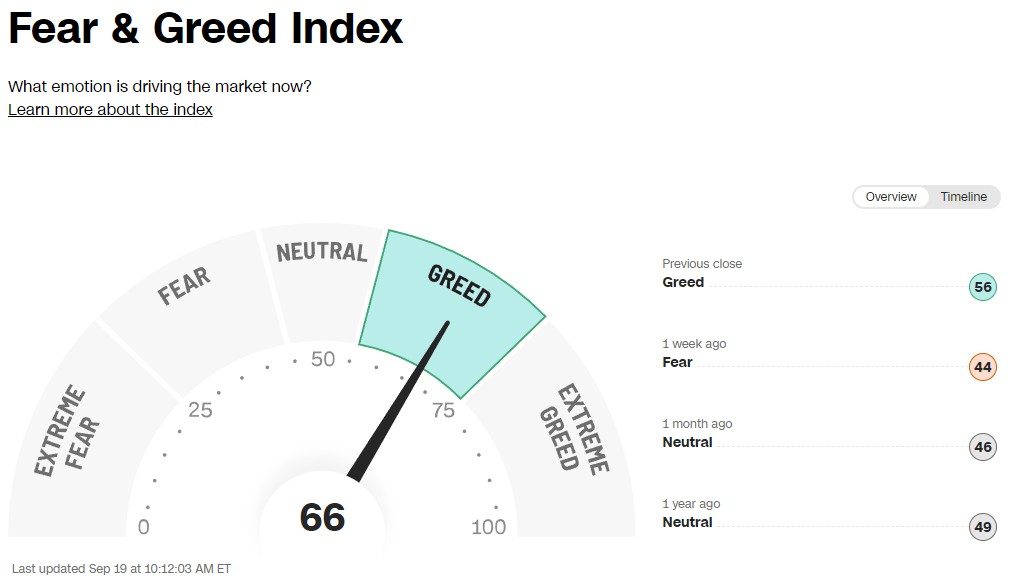

Fear and Greed Index below to understand why it’s crucial to keep an eye on sentiment in these volatile times.

Let's dive into an in-depth lesson that explores the emotional state and how it influences our decision-making and overall mindset.

Lessons from the Trenches 📚

It was one of those days that every trader dreads, yet secretly craves—the kind where the market has already sprung pre-market before the NY open. The whispers about a gamma squeeze had started the day before, and by the time I sat down at my desk that morning, the chatter was deafening. There was a sense of impending chaos in the air.

As a full-time observer of the market, I had seen these squeezes before. I knew the drill: fast price movements, intense volatility, and, if you weren’t careful, a brutal lesson in humility. This time, I wasn’t just anxious about the market. I was afraid—afraid that this gamma squeeze would push me into making the exact kind of emotional decisions I had worked so hard to avoid.

The day already began on a huge gap up. The market steadily rising for a few days, but something was different. I had noticed unusual options activity—large volumes of call options clustering around specific strike prices, indicating that a squeeze was brewing.

I knew all this, and yet, as the price climbed way above those critical levels well before the NY open, a knot started to form in my stomach. It wasn’t the usual pre-trade jitters.

My biggest fear? Losing control.

By mid-morning, the upside squeeze was still full effect and not showing any signs of slowing down. Every time the price ticked up, it sent ripples through the options chain, triggering even more buying pressure from market makers who were now forced to hedge.

Suddenly, the fear of missing out (FOMO) collided with the fear of losing my gains. Should I hold for more, or should I get out while I was ahead? The emotional tug-of-war began.

I found myself staring at the screen, watching the chart move in ways that defied logic, unsure of what to do next. My heart was pounding, and the voice in my head kept saying: “You’re going to mess this up.”

Here’s the thing about trading: fear isn’t just about losing money. For me, it was about losing control—control of my emotions, my plan, and my ability to make rational decisions.

In that moment of fear, I remembered something that had helped me before—my plan and checklist. I had created a detailed trading plan for this exact situation, with clear exit strategies and predefined stop-losses.

So, I did the only thing I could think of: I stepped away.

I physically removed myself from my desk for a few minutes, took a deep breath, and refocused. The major reversal was a known event, and while I couldn’t control the market, I could control my reaction to it.

When I returned to my desk, I had set a target for profit-taking, and I stuck to it. No moving targets, no chasing the market, no letting fear decide for me. The plan was in place to protect me from exactly what I was feeling.

As the price moved higher, I took partial profits at my target levels, ensuring I locked in gains but left room for more upside. I also adjusted my stop-loss to protect against a potential reversal. I wasn’t going to be greedy, and I wasn’t going to panic-sell. I was going to follow my strategy.

And that’s when it hit me: fear only controls you if you let it. The market was still volatile, but I wasn’t. I was back in control, and that’s when the fear started to melt away.

That day, I realized that my biggest fear during a monumental move wasn’t the squeeze itself—it was the fear of losing control. But by stepping away, refocusing, and trusting my plan, I transformed that fear into fuel for better decision-making.

Now, whenever I step into a volatile market, I tell myself: I've conquered this chaos before, and I’m more than ready to do it again!

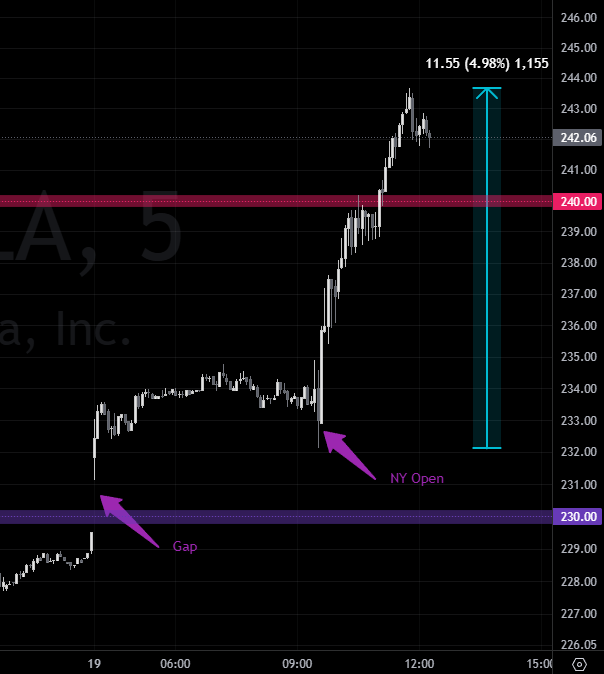

Tesla Impulse (+4.98%)⚡🚗

Tesla significantly outpacing the S&P 500’s 1.7% rise and the Dow’s 1.3% gain

The Fed’s larger-than-expected rate cut has given a lift to long-duration growth stocks.

With lower interest rates making auto financing more affordable, demand for cars, including electric vehicles, is expected to rise.

Tesla and other automakers like Toyota and Honda saw stock increases in response.

Despite declining EV sales in Europe, Tesla is on track for a strong quarter in China, selling more than 15,000 cars in the past week alone

Tsla 230 (0DTE Highest Level of Call Gamma)

Tsla 240 (0DTE 2nd Highest Level of Call Gamma)

0DTE Levels: Zones of significant options volume in underlying assets, that can trigger an increase of volatility as the expiration approaches

These market levels are recalculated and updated daily, taking into account factors like gamma expiration, trading volume, and market volatility.

Coverage include Stocks, ETFs, Indices, Futures, and Crypto. For the most up-to-date levels and analysis, all information is available on MenthorQ.

End of Day Headlines 📰

Financial stocks saw strong gains today, with the NYSE Financial Index up 1.3%, supported by advances in major sectors such as energy and housing.

S&P 500 is maintaining momentum, hitting all-time highs as bullish sentiment dominates the market.

Commodities like crude oil also saw notable increases, with West Texas Intermediate crude rising 1.4% to $71.90 per barrel and Brent advancing to $74.69.

The rally was driven by a combination of factors, including a favorable labor market report showing a decline in U.S. initial jobless claims to 219,000, alongside continued strong performances in energy stocks.

Closing Mindset 🧠

The gamma squeeze was just a reminder that no matter how much the market swings, the real battle is internal.

The fear of losing control is something every trader faces, but what separates successful traders from the rest is their ability to recognize that fear and act in spite of it.

I learned that fear is not something you conquer once and for all. It shows up every time you’re faced with uncertainty or a fast-moving market like a gamma squeeze or any other real life situation.

The key is to be prepared, to have a plan, and to trust yourself to follow it—even when everything around you feels like chaos.

Until next time,

Steve Benyi

Founder, The Daily Impulse

Interested in learning how I manage risk and identify key levels in the market?

Join the community and be part of the journey!

New here? Join the newsletter below!

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices.