NYSE

Hello, my friends!

📊 Wall Street is bracing for the Federal Reserve’s upcoming rate cut decision - and big money is sitting tight, waiting to strike.

❓ Tomorrow’s announcement holds the keys to the market’s next major direction, which means today’s action in Nasdaq is more about positioning than conviction.

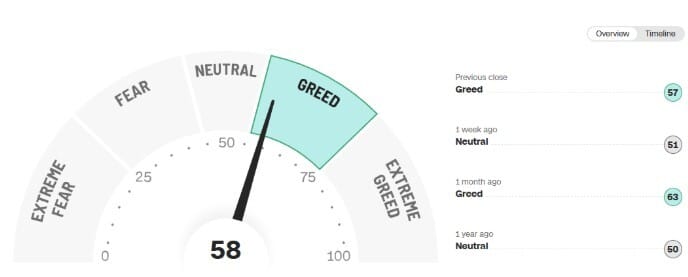

Greed Mode

The Fear & Greed Index has pushed firmly into greed territory.

No surprise here - Markets are charging into uncharted territory, what I call “no man’s land.”

This zone demands a reset: new supply and demand levels must form before the next leg higher (or lower) can take shape.

NQ Futures

One of the top questions I hear from members around this time is: “Why do we see such big gaps on the charts during futures rollovers?”

It’s a fair question - and whether you’re a beginner or a seasoned trader, understanding rollover mechanics is critical. So today’s lesson dives right into that.

The CME Gap

🔍Why Today’s Gap Appeared

Quarterly Expiration: Nasdaq futures (NQ) trade on a quarterly cycle - March, June, September, and December. As one contract nears expiration, trading activity shifts into the next month’s contract. This transition is called the rollover.

Liquidity Migration: Large funds and institutions always seek the deepest liquidity. As open interest builds in the new contract, volume naturally migrates there, causing short-term price differences.

Spread Differences: The outgoing and incoming (next month) contracts don’t always align perfectly. Variations in interest rates, dividends, and cost of carry can create small premiums or discounts between contracts.

Chart Gaps: When platforms roll over to the new “front month,” those pricing differences show up as gaps on the chart. Importantly, these aren’t sudden surges of buying or selling - they’re purely mechanical.

📈 Historical Context

Seasonal Pattern: This process occurs four times per year during each expiration cycle.

Market Behavior:

Short-term traders often fade the initial move until liquidity stabilizes.

Institutional players roll positions methodically, meaning the gap effect usually resolves within 1–2 sessions.

Extreme Cases: During periods of stress - such as March 2020’s pandemic shock or the late 2021 tech unwind - roll gaps have exceeded 100+ points.

Today’s gap wasn’t about sudden momentum or a hidden catalyst - it was simply the mechanics of rolling into the December contract. Traders should always be mindful of these quarterly transitions when analyzing charts, as they can distort short-term signals.

Trade Of The Week

Alpha Futures

My standout trade this week came on Friday, when Nasdaq broke through its all-time highs.

Many traders see this kind of move as “uncharted territory,” assuming there are no clear supply or demand zones to work with.

But this is where my edge comes in: I rely on options market data - specifically gamma exposure levels from QQQ and SPY - to identify intraday zones of support and resistance - at BlackBoxStocks.

These levels consistently provide structure even when the chart alone looks uncertain.

👉 If you’ve ever wondered how to properly use gamma exposure to guide your trading decisions, CLICK here to book an intro session on Calendly.

I’m now focused on securing a 2nd payout on this account. I’ll be trading alongside the BlackBox community, documenting the process for more detailed stats once this next milestone is complete.

BlackboxStocks

Live Gamma Levels and premium options data - built for disciplined growth. [Access the breakout sale]

Alpha Futures

Low-cost entry, industry-leading payout cap. Test your skills and scale responsibly. Use code TDI

E8 Futures

No activation fee and 1-day pass available. Use code TDI

Disclosure: Partner offers. Trading futures involves risk; only trade with capital you can afford to lose. This is not financial advice.

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

What’s your trading story?

Hit reply and tell me - then jump to X to keep the momentum going.

Until next time,

Steve B

Founder, The Daily Impulse

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. I am not a registered investment advisor, broker, or licensed financial professional. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices. Trading and investing involve significant risks, including the potential for substantial financial loss.

Some content, including advertisements, promotions, or links, may be sponsored or part of affiliate programs (such as with proprietary trading firms). I may receive compensation, commissions, or other benefits if you click on affiliate links, sign up for services, or make purchases through them. These relationships do not necessarily imply endorsement, and all opinions expressed are my own unless stated otherwise. Potential conflicts of interest may exist due to these partnerships.

Past performance or examples discussed are not indicative of future results. I do not guarantee the accuracy, completeness, or timeliness of the information provided, and I disclaim any liability for errors, omissions, or any losses incurred as a result of using this content.

Third-party websites are for your convenience and informational purposes only. Please note that we have no control over the content, policies, or practices of any third-party sites. We recommend reviewing the terms and privacy policies of any third-party sites you visit. By subscribing or reading this newsletter, you agree that you will not hold me or any associated parties responsible for any actions you take based on its content.