Hello, my Friends!

📰 The market continued yesterday’s selling pressure today, with a slight mid-session squeeze prompted by PMI data.

💸 Then, in classic headline-grabbing style, President Trump stepped in - this time, not with immediate new tariffs, but by delaying potential duties on Canada and Mexico.

Dow Jones

Here’s a quick rundown:

U.S. weighs a one-month delay of Canada and Mexico tariffs on autos.

Trump held a call Tuesday with the CEOs of GM, Ford, and Stellantis to discuss the potential delay.

A follow-up call with Canadian Prime Minister Trudeau reportedly ended on a “somewhat” friendly note.

Concerns about fentanyl efforts remain high on the agenda, complicating trade talks.

Headlines like these can flip your trading bias or broader outlook on a dime - and it’s precisely this unpredictability that fuels big market impulses.

Fun Fact 🤓

The Tariff Act of 1789 was among the first major pieces of legislation passed by the U.S. Congress, aiming to raise revenue for the young nation and protect emerging American industries. Fast-forward more than two centuries, and tariffs still make front-page headlines, shaping diplomatic relations and triggering market volatility in real time.

Market Sensitivity: Tariffs can trigger sudden, dramatic moves in stock prices—even in periods that seem otherwise stable.

Historical Perspective: While tariffs may drive short-term turbulence, markets typically adjust once the scope of any new policy becomes clearer.

Staying informed and ready to adapt - whether you’re a trader or a long-term investor - can help you navigate today’s rapidly changing market landscape.

Partners👥

Ready to discover the ultimate journaling software?

Click here for free trial and if TraderSync meets your journaling needs, unlock 15% off with code: tdi

Are you curious to see the charts in action?

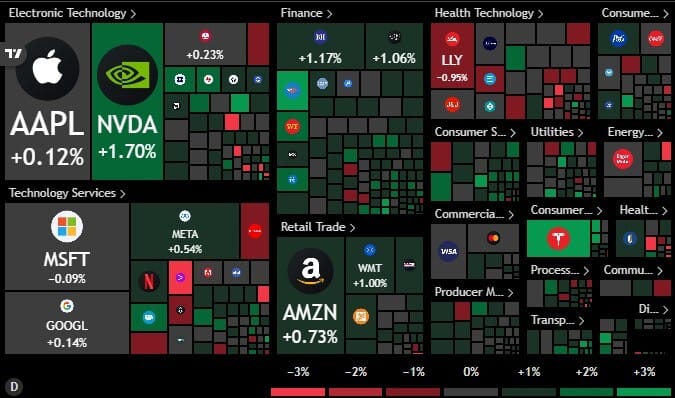

Click the heatmap below for your exclusive invitation to Trading-View - and enjoy extra benefits along the way!

BofA says +80% of young, wealthy investors want this asset—now it can be yours.

A 2024 Bank of America survey revealed something incredible: 83% of HNW respondents 43 and younger say they currently own art, or would like to.

Why? After weathering multiple recessions, newer generations say they want to diversify beyond just stocks and bonds. Luckily, Masterworks’ art investing platform is already catering to 60,000+ investors of every generation, making it easy to diversify with an asset that’s overall outpaced the S&P 500 in price appreciation (1995-2023), even despite a recent dip.

To date, each of Masterworks’ 23 sales has individually returned a profit to investors, and with 3 illustrative sales, Masterworks investors have realized net annualized returns of +17.6%, +17.8%, and +21.5%

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

Until next time,

Steve B

Founder, The Daily Impulse

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices.

Third-party websites are for your convenience and informational purposes only. Please note that we have no control over the content, policies, or practices of any third-party sites. We recommend reviewing the terms and privacy policies of any third-party sites you visit.