Hello, my Friends!

This is a short week - Thanksgiving, Black Friday, half the street already sipping eggnog in vacation mode.

📉 Volume is thin and the temptation to coast is louder than ever. But - distractions don’t compound - discipline does!

☕ While others spill coffee on their keyboards and let the holiday blur their edge, the serious players treat every session the same - no exceptions!

🖥️ Same screen time. Same trend-following rules. Same refusal to chase reversals or force setups that aren’t there.

I’m not here to flaunt my prop-firm journey so you can copy-paste it. I’m here to remind you what’s possible when you stack years of deliberate - day after day, week after week, even when the calendar screams “slow down.”

So ask yourself: When the year-end finish line is this close, will you let a few quiet days erode your consistency… or will you lock in and protect your equity curve?

Thanksgiving Stats

While the U.S is debating turkey versus ham, the data tells a far more interesting story: Thanksgiving week is quietly the most profitable week of the entire calendar year.

Here are the numbers:

Since 1950, the S&P 500 has delivered an average return of +0.93% during Thanksgiving week (Monday–Wednesday + Friday half-day) - the single highest-performing week of the year.

It closes positive 73% of the time - outperforming the legendary Santa Claus Rally and every other holiday period.

The Wednesday before Thanksgiving? The most reliably bullish single day on the calendar: up 70% of the time with an average gain of +0.7%.

Black Friday itself is surprisingly average - but don’t sleep on Cyber Monday. It has been the strongest single trading day in November for over two decades. With thin liquidity, moves can be sharp and unforgiving. The half-day session on Friday actually records the highest intraday volatility of any abbreviated day all year.

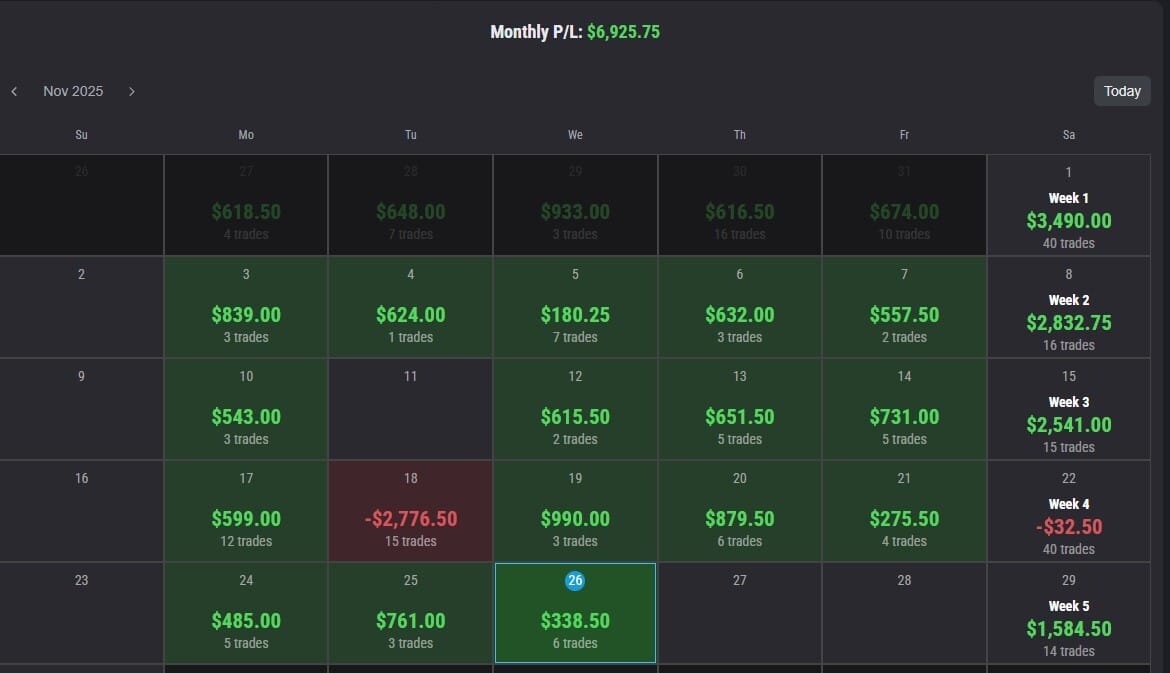

Monthly Trading Recap

November Stats

With U.S. equity markets closed today for Thanksgiving, I’ve elected to stand aside from all trend-following entries - but I will be back the following day. Low-liquidity holiday sessions are notorious for false breakouts - conditions that offer no edge under my rules-based framework. Instead, let’s use this quiet day for a transparent month-end reflection.

This journaled prop account is now in Phase 3 of the evaluation roadmap to a fully funded live desk. To date, I have successfully secured two payouts, keeping firmly on trajectory while respecting every risk parameter.

Mid-month (November 18), the market entered a pronounced chop/range regime. Three consecutive high-probability setups stopped out in succession. Rather than immediately shrinking back, I honored my pre-defined rules and continued executing the plan. In hindsight, that sequence temporarily pushed me into slight over-trading within the session.

Crucially, the equity curve was protected - most importantly - the psychological capital stayed intact. The losses were recouped over the following sessions with zero emotional override. The market will periodically enter low-probability chop zones. Recognizing them quickly and reducing size is a professional skill, not a weakness.

Obsessing over the rear-view mirror drains energy from the only thing you can control: the present setup and the next decision. Capital preservation compounds faster than most traders realize. One avoided blow-up is worth dozens of marginal wins.

11/26/25 End of Day

As we close out the month, stay locked into the current market regime and always honor your rules. Enjoy the holiday with family and friends. Grateful for this community and the accountability it demands.

Ready to Boost Your WFH Productivity?

Newsletter Partner

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Enjoy the holiday and wishing fellow Americans a prosperous and peaceful Thanksgiving,

Until next time,

Steve B

Founder, The Daily Impulse

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. I am not a registered investment advisor, broker, or licensed financial professional. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices. Trading and investing involve significant risks, including the potential for substantial financial loss.

Some content, including advertisements, promotions, or links, may be sponsored or part of affiliate programs (such as with proprietary trading firms). I may receive compensation, commissions, or other benefits if you click on affiliate links, sign up for services, or make purchases through them. These relationships do not necessarily imply endorsement, and all opinions expressed are my own unless stated otherwise. Potential conflicts of interest may exist due to these partnerships.

Past performance or examples discussed are not indicative of future results. I do not guarantee the accuracy, completeness, or timeliness of the information provided, and I disclaim any liability for errors, omissions, or any losses incurred as a result of using this content.

Third-party websites are for your convenience and informational purposes only. Please note that we have no control over the content, policies, or practices of any third-party sites. We recommend reviewing the terms and privacy policies of any third-party sites you visit. By subscribing or reading this newsletter, you agree that you will not hold me or any associated parties responsible for any actions you take based on its content.