Hello, my Friends!

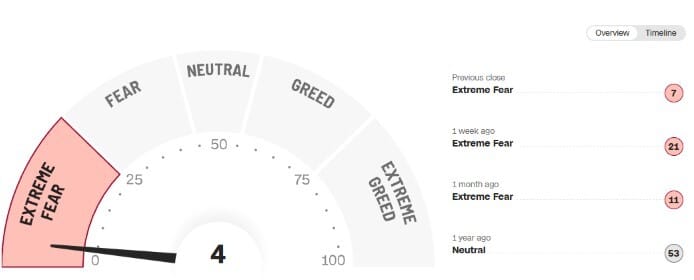

📉 What a week it has been! Markets shattered records - but unfortunately, plunging dramatically to new depths.

🔄 During turbulent times like these, Fridays become even more essential for our Mindset Reset.

👣 I've intentionally structured Fridays this way because many of my clients find it crucial to step back, reset, and regain their perspective.

🗓️ Accountability and clarity help us leave behind the challenges of the week and step positively into the weekend, ready to face the future rather than dwell on the past.

But let's be clear - a Mindset Reset isn't only beneficial for traders or investors. It’s an essential practice for everyone, no matter your career or lifestyle.

If you're ever feeling stuck or overwhelmed and need to reset your mindset, don’t hesitate to hit “reply” to this email. Together, we’ll find a solution tailored specifically for you. ✨

Lessons from the Trenches

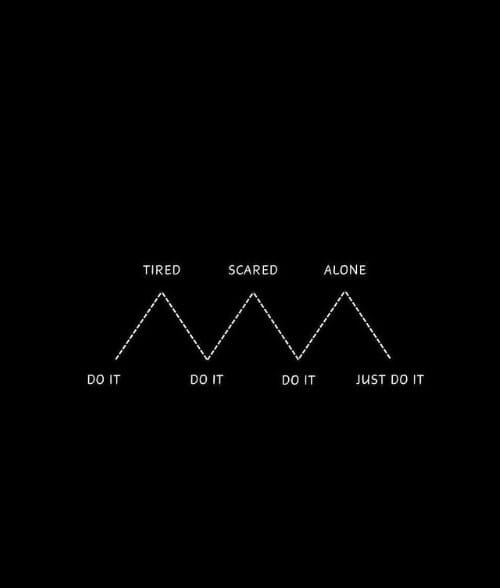

Today, let’s dive into a personal story that emphasizes the importance of resilience, especially when external circumstances seem uncontrollable.

🌩️ James - the main character - stared blankly at his trading screens. Headlines screamed panic: "Economic Crisis Looms!" "Markets in Freefall!" His carefully laid-out plans seemed helpless against the rising tide of uncertainty. Anxiety surged, clouding his judgment, each flashing red candle on his charts intensifying his dread.

"Why now? This wasn't supposed to happen!" He thought desperately.

Panicked and overwhelmed, he deviated from his disciplined strategy, frantically adjusting positions, ignoring the clear risk rules he usually trusted. By the close of trading, heavy losses left him exhausted, doubtful, and utterly defeated.

That evening, pacing anxiously in his office, James caught a glimpse of himself reflected in the window - exhausted and drained.

"Enough," he whispered defiantly.

In that moment, a powerful piece of advice from his mentor at The Daily Impulse echoed clearly:

"You cannot control the storm - but you can manage your own ship."

This simple yet profound insight sparked an instant mindset shift. James realized he'd spent the entire day focused on external chaos -economic headlines and uncontrollable external forces - instead of the one thing he could control: himself.

Resolute, James reached for his journal and wrote down four powerful reminders:

✅ My Reactions: "I choose calm, deliberate responses over emotional panic."

✅ Daily Habits: "Tomorrow, I recommit to mindfulness meditation, journaling, and quality rest."

✅ Risk Management Strategy: "I will trust and adhere strictly to my predefined risk parameters."

✅ Decision-making Process: "I will remain disciplined and avoid impulsive reactions influenced by external panic."

The next morning, he rose early, feeling clear-headed and focused. He started with journaling his intentions, he reaffirmed his risk strategy and prepared himself mentally for whatever came next.

When the markets opened with continued volatility, James was ready. But this time, something had changed. He felt calm, focused, and in control. He methodically executed his plan, carefully managing risk and responding deliberately instead of reacting impulsively.

He vividly understood the true meaning of resilience: It wasn't about predicting every storm, but confidently knowing exactly what he could control.

💪 When external chaos strikes, remember to shift your energy!

🌱 Like James, anchor yourself to daily mindset habits. Storms always pass, but your resilience stays with you forever.

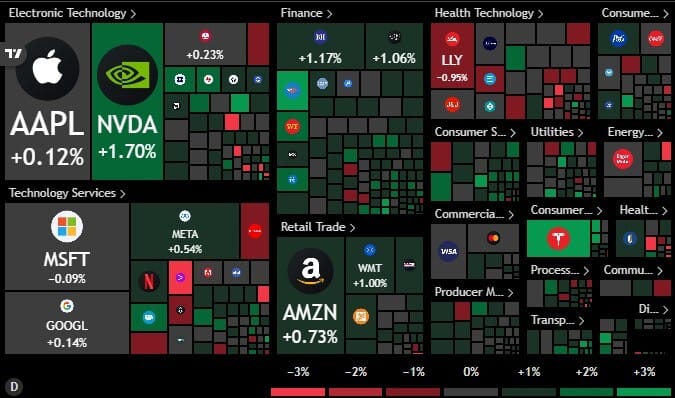

Market Rundown

Nasdaq Nears Bear-Market Territory after China announces retaliatory tariffs on all U.S. goods, significantly escalating trade tensions.

Fed Chair Powell Issues Warning:

Tariffs are "larger than expected," raising concerns about slower economic growth and persistently higher inflation, creating a challenging scenario for monetary policy.Investors Flee to Safe Havens:

Global stocks plummet, sending investors rushing into U.S. Treasuries and other low-risk assets, while even safe-haven gold retreats from recent highs amid fears of recession.U.S. Treasury Yields Plunge:

Yields sharply lower amid escalating tariff threats, though a solid U.S. jobs report slightly mitigated losses.Asian Markets Brace for Impact (Fred Neumann, HSBC)

“Japan and Asia particularly vulnerable as global trade tensions intensify.”Investors Reassessing Bank Stocks and Rates (Sean Taylor & Jon Withaar)

“Tariffs dampen rate-hike expectations, prompting strategic shift to defensive sectors like real estate and construction.”

Partners

Ready to discover the ultimate journaling software? Click here for free trial and if TraderSync meets your journaling needs, unlock 15% off with code: tdi

Are you curious to see the charts in action? Click the heatmap below for your exclusive invitation to Trading-View - and enjoy extra benefits along the way!

Today’s Fastest Growing Company Might Surprise You

🚨 No, it's not the publicly traded tech giant you might expect… Meet $MODE, the disruptor turning phones into potential income generators.

Mode saw 32,481% revenue growth, ranking them the #1 software company on Deloitte’s 2023 fastest-growing companies list.

📲 They’re pioneering "Privatized Universal Basic Income" powered by technology — not government, and their EarnPhone has already helped consumers earn over $325M!

Invest in their pre-IPO offering before their share price changes on May 1st.

*An intent to IPO is no guarantee that an actual IPO will occur. Please read the offering circular and related risks at invest.modemobile.com.

*The Deloitte rankings are based on submitted applications and public company database research.

Share your entrepreneurial journey - just hit “reply” to this email and let’s keep the conversation going on X.

Until next time,

Steve B

Founder, The Daily Impulse

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices.

Third-party websites are for your convenience and informational purposes only. Please note that we have no control over the content, policies, or practices of any third-party sites. We recommend reviewing the terms and privacy policies of any third-party sites you visit.