Hello, my friends!

Wall Street is on fire, charging back from April’s tariff-induced meltdown in a rally some are calling "The Great Reversal."

🌊 Markets are riding a wave of optimism, but whispers of caution linger: Are we overheating, or is this bull run just getting started?

🔥 Historically, these trends can gallop for months before showing signs of fatigue.

Gold

One asset is stealing the spotlight, soaring to unprecedented heights with 50%+ gain this year: Gold.

This isn’t just a rally - it’s a spectacle…

Headlines

Gold smashes past $4,000, with silver breaking $50 for the first time, signaling a historic surge.

Safe-haven demand and bets on Federal Reserve rate cuts have propelled gold to record highs.

Amid a prolonged U.S. government shutdown, gold remains a rock-solid barometer of unease.

Analyst Ross Norman notes: “Gold gauges when things just aren’t right.”

I rarely dive into commodities - I don’t day-trade it - but how can you ignore those electrifying charts?

This is a moment for the history books. Will gold keep climbing, correct by 50%, or settle into a decade-long consolidation? Only time will tell. At the end of the day, savvy investors are pouring depreciating dollars into gold, real estate, and stocks to combat inflation.

History Lesson: The Gold Standard

Inflation erodes purchasing power, tracked by the Consumer Price Index (CPI). Modern U.S. inflation surged after 1971's "Nixon Shock," ending the dollar's gold convertibility and shifting to fiat currency, enabling easier money printing amid wars and spending.

1970s: The Great Inflation - Oil shocks (1973 embargo, 1979 revolution) and loose policy drove stagflation: high inflation (peaking at 13.5% in 1980) with unemployment. Rates averaged 7-11%.

1980s: Taming the Beast – Fed Chair Paul Volcker hiked rates to 20%, causing recessions but slashing inflation to under 4% by 1983. This restored policy credibility.

1990s-2000s: Great Moderation – Stable 2-3% inflation from better Fed targeting, globalization, and tech booms. The 2008 crisis briefly caused deflation (-0.4% in 2009).

2010s: Subdued Era – Despite massive stimulus post-recession, inflation hovered at 1-2% due to weak demand and low oil prices. Fed set a 2% target in 2012.

2020s: Pandemic Spike – COVID disruptions and $5T stimulus pushed inflation to 8% in 2022, worsened by Ukraine war. Fed's rate hikes (to 5%+) cooled it to ~3% by 2025, nearing target.

Fiat money risks inflation, but independent central banking has kept it mostly in check since the 1980s, though supply shocks remain a threat.

Lucid Update: Decoding The Sharp Ratio

October Results

In the high-stakes world of markets, raw profits tell only half the story. Enter the Sharpe Ratio - a metric for any serious trader.

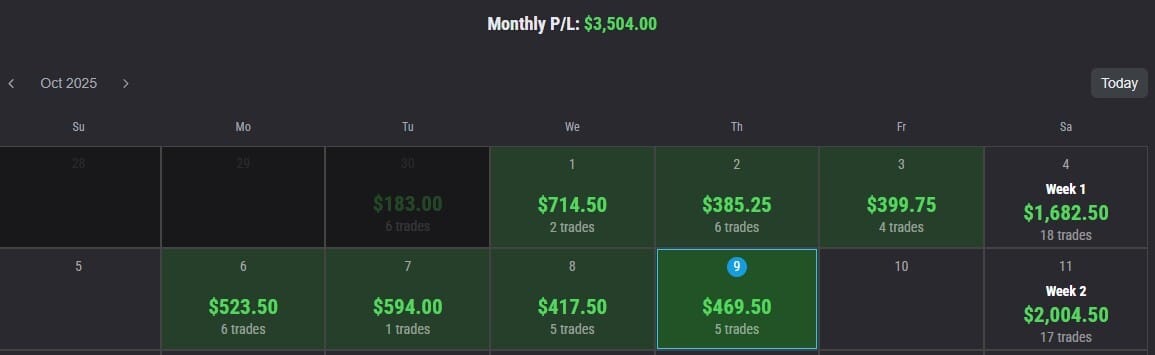

Over the past week, my Lucid futures trades (MESZ5 and MYMZ5) yielded a net profit of $1,934.75 (Oct 3-8) across four active days. I always scrutinize the Sharpe Ratio to gauge true performance, separating skillful execution from reckless volatility.

Dow Jones Short

Think of it as a comprehensive blood panel for your portfolio. The Sharpe Ratio normalizes returns by the risk endured, exposing whether your gains stem from strategic prowess. In volatile markets, it's your reality check - ensuring consistency trumps fleeting highs.

Here's the breakdown from my recent results:

Mean Daily Net PnL: $483.69

Standard Deviation of Daily Net PnL: $91.62 Daily Sharpe Ratio: 5.28.

A Sharpe above 1 signals solid performance; above 2 is exemplary. This elevated figure highlights exceptional risk-adjusted returns in this snapshot - driven by steady profits and minimal variance.

👉 If you’d like to join me on this journey, you can use my partner link and discount code: “TDI” to get started.

Alpha Futures

Low-cost entry, industry-leading payout cap. Test your skills and scale responsibly. Use code TDI

E8 Futures

1-day pass available. Use code TDI

Disclosure: Partner offers. Trading futures involves risk; only trade with capital you can afford to lose. This is not financial advice.

🚨 Automate yourself appearing on Hundreds of Great Podcasts

If you're an entrepreneur of any kind, frequent podcast guesting is the NEW proven & fastest path to changing your life. It's the #1 way to get eyeballs on YOU and your business. Podcast listeners lean in, hang on every word, and trust guests who deliver real value (like you!). But appearing on dozens of incredible podcasts overnight as a guest has been impossible to all but the most famous until now.

Podcast guesting gets you permanent inbound, permanent SEO, and connects you to the best minds in your industry as peers.

PodPitch.com is the NEW software that books you as a guest (over and over!) on the exact kind of podcasts you want to appear on – automatically.

⚡ Drop your LinkedIn URL into PodPitch.

🤖 Scan 4 Million Podcasts: PodPitch.com's engine crawls every active show to surface your perfect podcast matches in seconds.

🔄 Listens to them For You: PodPitch literally listens to podcasts for you to think about how to best get the host's attention for your targets.

📈 Writes Emails, Sends, And Follows Up Until Booked: PodPitch.com writes hyper-personalized pitches, sends them from your email address, and will keep following up until you're booked.

👉 Want to go on 7+ podcasts every month and change your inbound for life? Book a demo now and we'll show you what podcasts YOU can guest on ASAP:

What’s your founder story?

Hit reply and tell me - then jump to X to keep the momentum going.

Until next time,

Steve B

Founder, The Daily Impulse

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. I am not a registered investment advisor, broker, or licensed financial professional. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices. Trading and investing involve significant risks, including the potential for substantial financial loss.

Past performance or examples discussed are not indicative of future results. I do not guarantee the accuracy, completeness, or timeliness of the information provided, and I disclaim any liability for errors, omissions, or any losses incurred as a result of using this content.

Third-party websites are for your convenience and informational purposes only. Please note that we have no control over the content, policies, or practices of any third-party sites. We recommend reviewing the terms and privacy policies of any third-party sites you visit.

This newsletter may contain paid advertisements or sponsored content from third parties, including through the Beehiiv ad network. These are clearly labeled as such and do not constitute endorsements or recommendations from me.