"The market doesn't react to news; it reacts to the reaction to news. In every reversal, opportunity is born from overreaction."

Hello, my friends!

In today’s volatile markets, smart risk management is everything—especially when we see sharp reversals against the previous day's bearish action.

When the market flips direction like this, it’s critical to stay disciplined and keep risk front and center.

Protecting your capital and sticking to your strategy is what keeps you in the game, no matter the noise.

⚡U.S JOLT July Job Openings Plunge to 3-Year Low

The JOLTS (Job Openings and Labor Turnover Survey) report provides key insights into the U.S. labor market, showing the number of job openings, hires, and separations. In the most recent release, job openings fell to a three-year low, signaling potential softening in the job market. The report also fueled speculation of potential Federal Reserve rate cuts due to cooling economic conditions.

In July, job openings dropped to 7.67 million, their lowest in three years, signaling a major shift in the labor market.

The gap between job vacancies and unemployed workers has narrowed, almost reaching parity. This news fueled expectations of rate cuts, sending bond markets rallying while equities had a more muted response.

With labor data tightening, all eyes are now on the Fed's next move!

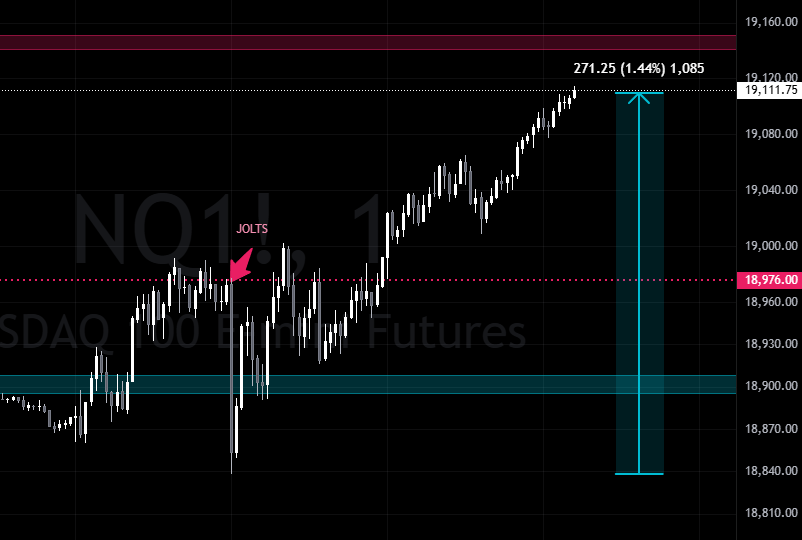

🏙️Nasdaq’s Impulse – 1.44% Reversal!

After the initial one-minute candle post-news reaction, we witnessed an exciting 1.44% impulsive move. Once the dust settled, large volume poured in, driving a sharp reversal.

The bulls took control, pushing price towards the next supply zone. This momentum shows how quickly the market can turn on volume, offering a powerful move for those watching the key levels.

NQ 18,900 (0DTE Demand): This level has shown significant buying interest, marking a critical demand zone where buyers are stepping in to support price.

NQ 19,150 (0DTE Supply): On the flip side, we’re seeing strong confluence and pressure around this area, making it a key supply zone for potential resistance.

These levels are recalculated and adjusted daily based on the previous day’s price action and volatility. Exposed areas between these zones are prime for sharp moves, making them crucial for short-term traders looking to capitalize on volatility.

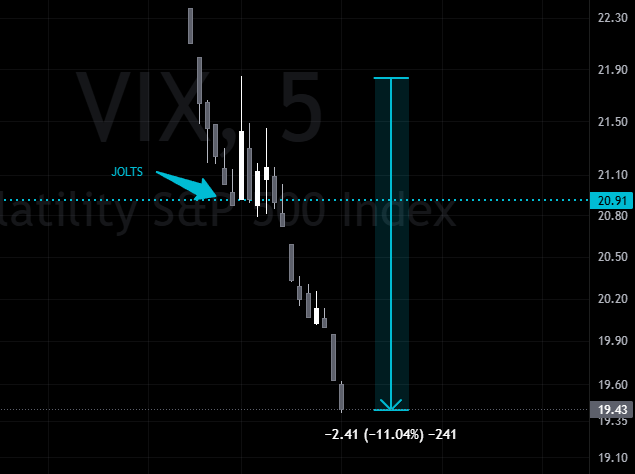

🔄The Great Hedge

The VIX plummeted around 11.04% before volatility finally cooled off. This major move reflected the inverse hedge effect, perfectly aligning with the broader market reversal after the JOLTS report.

Now we watch the 19-20 range to see if price breaks up or down from this important area and into the next trading day

As fear briefly gripped the market, traders quickly recalibrated their positions, leading to a sharp cooldown in volatility. This shows how fast sentiment can shift, making it crucial to keep an eye on volatility indicators like the VIX for actionable trading opportunities in these fast-moving environments.

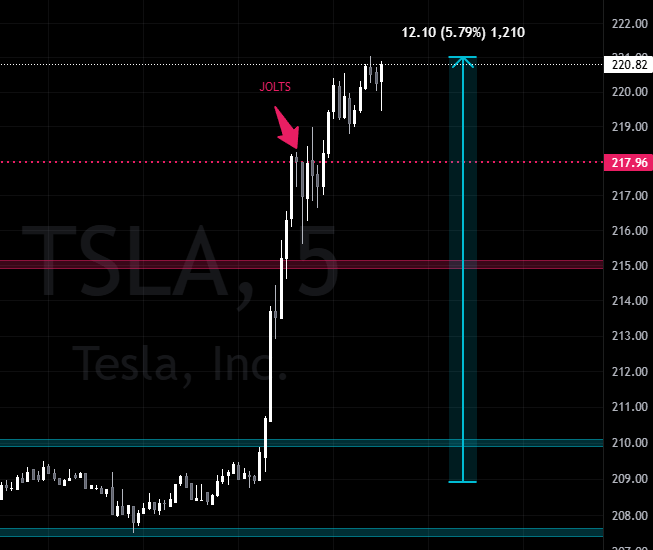

🚀Tesla Rockets Ahead of News – 5.79% Impulse!

Tesla broke through supply lines well before the JOLTS news hit the tape, skyrocketing with a total impulse move of 5.79% before cooling off.

While there was a brief sell-off once the news dropped, Tesla showed strength by reversing even faster than the major indices.

Tsla 207.5 - 210 (0DTE Demand) This range had significant demand around where buyers have consistently stepped in to support price action

Tsla 215 (0DTE Supply) The key previous day resistance zone acted as strong supply then flipped quickly into demand as momentum shifted

Live Headline: Tesla’s China EV Sales Spike – Time to Buy?

Tesla’s China EV sales surged in August, reflecting significant growth in one of the world’s largest EV markets. This momentum could be a game-changer for Tesla, as its growing presence in China solidifies its global dominance.

With demand ramping up and competition heating up, the question is whether this is the right moment to buy TSLA stock. While short-term volatility remains, the long-term prospects driven by international expansion and EV demand are looking strong.

🧠Closing Mindset

The market delivered some powerful moves today, driven by key reversals and volatility.

Whether it's navigating the reaction to news or spotting prime levels of supply and demand, each day brings fresh opportunities.

Let’s keep riding the pulse of the market—tomorrow promises even more action!

Until next time,

Steve B.

Founder, The Daily Impulse

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices.