"Success in trading isn’t about taking every opportunity—it’s about waiting for the right ones. When confluences align, confidence follows."

Hello, my friends!

Today, we’re diving into one of the most powerful tools in your arsenal—confluences—and how they can dramatically boost your decision-making, not just in trading but in every aspect of your life.

In trading, confluences are game-changers.

They stack the odds in your favor by reinforcing your confidence when entering or exiting a trade.

It spots those key signals aligning perfectly, giving you the edge you need for successful trade management.

And today, the major indices gave us a textbook example of why confluences are crucial for managing trades effectively!

However, confluences don’t stop at trading—they’re just as vital in your everyday life.

Think about it! When making big decisions, whether launching a new business or making personal moves, having multiple confirmations—like solid market research, trusted advice, and gut instincts—gives you the clarity to move forward confidently.

Whether in the markets or your day-to-day life, confluences are your safety net, leading to smarter choices, greater success, and long-term wins.

Keep an eye out for them, and watch how they transform the way you approach every opportunity!

Lessons from the Trenches 📚🛠️

Picture this: it’s a regular trading day, but the market feels anything but regular. The charts are erratic, your usual levels are broken, and you’re left wondering if any of your setups will work today. Stuck in the mental loop of uncertainty, staring at your screen, watching every tick with growing anxiety. You've taken a few trades, some losses here, a few break-evens there—nothing’s working. Doubt creeps in. "Am I even cut out for this?"

This is the nightmare scenario so many traders find themselves in: the unpredictability of the market overwhelming their every move. Your trading career seems like a never-ending emotional rollercoaster.Stress and frustration take over.

Now imagine this. You’re trading with confidence. Your timing is more precise, your exits controlled, and most importantly, you’re calm. What changed?

You discovered the power of using the VIX as one type of confluence.

For those who don’t know, the VIX—often called the “fear gauge” of the market—measures volatility. It’s a direct reflection of the market’s uncertainty. And that’s where its real power lies.

But here’s the thing—trading is all about context, and context is where confluences come in. Before you learned to integrate the VIX into your decision-making process, you were blind to a crucial piece of the puzzle.

Early in my journey, I was confused as to why solid setups would fall apart. Then, one day, after yet another losing streak, I started noticing a pattern: whenever the VIX was spiking, my trades would collapse. The market was wild, driven by fear, and I was walking into it without a shield.

That’s when I started using the VIX as a confluence. Over time, I became more in tune with the emotional rhythm of the market—the same rhythm that used to make me second-guess every decision. Here are a few methods to analyze its rhythm:

Map out the major levels and set your alerts.

Wait for the VIX to hit those key levels,

Take note of when it happens and where the S&P & Nasdaq are at that exact moment.

This combination of location and time is a game-changer, giving you a powerful confluence that enhances your trade entries and exits. By aligning these two factors, you’re not just reacting to market volatility—you’re anticipating it with precision!

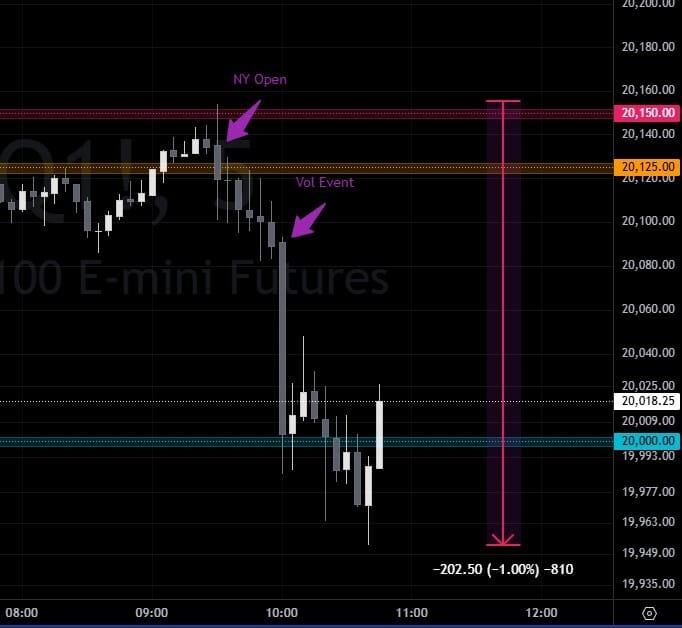

See example from todays price action:

This confluence indicator didn’t just save my portfolio. It saved my mindset. I learned that trading isn’t just about picking good setups; it’s about understanding the entire environment—the technicals, the sentiment, the volatility. It gave me the consistency and clarity I’d been searching for.

Trading doesn’t have to be a wild ride of constant stress. The market may be chaotic, but with the right confluences, you can stay ahead, stay steady, and most importantly, stay focused.

NY Impulse (+1.00%)🗽📈

9:30-12:00 Est

As expected, the Nasdaq opened right into the strongest supply zone of the day at 21,150, and it didn’t take long for the market to react—a sharp rejection followed.

But here’s where it gets interesting: we also saw a critical positive-to-negative shift from the options flow (20,125) , indicating that the longer price remained below this level, the greater the selling pressure would build

The next major 0DTE demand zone was the target at 20,000. This level was key, as price action swiftly pivoted, giving traders clear insight into the market’s pulse today.

Live Economic Event ⚡

US CB Consumer Confidence Actual 98.7 (Forecast 104, Previous 103.3)

US CB Consumer Confidence Report: Despite slower overall inflation and declines in some goods prices, average 12-month inflation expectations increased to 5.2% in September.

Traders boost odds of half-point November Fed rate cut to 50%.

NQ 20,000 (0DTE Highest Level of Put Support)

NQ 21,150 (0DTE Highest Level of Call Resistance)

NQ 20,125 (0DTE Positive/Negative Shift)

0DTE Levels: Zones of significant options volume in underlying assets, that can trigger an increase of volatility as the expiration approaches

These market levels are recalculated and updated daily, taking into account factors like gamma expiration, trading volume, and market volatility.

Coverage include Stocks, ETFs, Indices, Futures, and Crypto. For the most up-to-date levels and analysis, all information is available on MenthorQ.

Closing Confluence 🧠

In the world of trading, chance and luck can only get you so far.

True success comes from strategy, discipline, and a clear understanding of the forces at play.

That’s where confluences come in—they give you the confidence to make informed decisions, knowing that you’re relying on multiple signals, not just gut instinct or a single indicator.

Manage smart, trade steady, and most importantly, analyze with confluence.

Until next time,

Steve B

Founder, The Daily Impulse

Interested in learning how I manage risk and identify key levels in the market?

Join the community and be part of the journey!

New here? Join the newsletter below!

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices.