Hello, my friends!

😰 In times of global uncertainty, fear can trigger emotional responses that often lead to irrational decisions.

💡 Today, we’re switching gears to dive into the psychology behind that fear and explore how you can maintain a strategic mindset, even when markets seem to be in panic mode.

Extreme Mode

🧠Understanding the Mental Triggers🧠

Uncertainty and Ambiguity

Rapid changes and unclear information fuel anxiety, making it tough to evaluate risks and opportunities objectively. Our brains crave certainty, and when faced with ambiguity, we tend to overestimate potential dangers.

Information Overload

The constant stream of news and opinions in our digital age can heighten anxiety. When every headline screams disaster, it’s easy for panic to take hold - even when the underlying economic reality may not be as dire.

Herd Mentality

Widespread panic can spark a contagious cycle of reaction. When many people begin selling or panicking, it reinforces the fear, even if the move isn’t entirely rational.

Loss Aversion

Studies show that losses have a heavier impact on our psyche than gains. This bias can exaggerate the perceived threat of market downturns, pushing us towards overly cautious or conservative strategies.

♞Strategies to Overcome Self-Doubt♞

Adopt a Long-Term Perspective

Focus on your overarching business goals rather than getting caught up in short-term market fluctuations. This shift can help reduce the emotional impact of temporary downturns.

Practice Mindfulness

Incorporate mindfulness techniques - like meditation or deep-breathing exercises - to gain awareness of your emotional responses. Actively challenging negative thought patterns can transform fear into a more constructive analysis.

Establish a Solid Risk Management Framework

Implementing robust risk management strategies - such as diversifying investments, setting stop-loss limits, and maintaining an emergency fund - can alleviate anxiety and promote better decision-making.

Seek Support and Mentorship

Lean on a network of trusted advisors and peers who have navigated market volatility before. Their insights and support can help reinforce a balanced perspective and build resilience.

By embracing a long-term perspective and committing to continuous learning, you can transform fear into a powerful catalyst for innovative solutions.

⚡Market Impulse⚡

SP500 Index

Despite the pervasive market anxiety, today’s headlines have been dominated by significant developments:

Canada's Response: Preparing retaliatory tariffs on C$30 billion of US goods.

US Commerce Update: Commerce Secretary Lutnick confirms that tariffs on steel and aluminum imports will continue until a robust US industry is established.

Bank of Canada Insight: Gov. Macklem warns that the trade conflict with the US is likely to drive prices and inflation higher, weighing on growth.

Canada’s Finance Move: The Finance Minister announced that Canada will impose 25% retaliatory tariffs on US goods worth C$29.8 billion, effective March 13th.

Trump: Flexibility on tariffs, but there will be very little flexibility once we start.

📣Partners📣

Ready to discover the ultimate journaling software?📝

Click here for free trial and if TraderSync meets your journaling needs, unlock 15% off with code: tdi

Are you curious to see the charts in action?

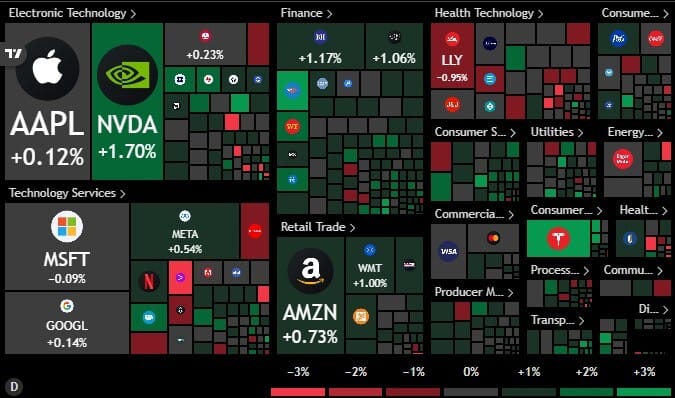

Click the heatmap below for your exclusive invitation to Trading-View - and enjoy extra benefits along the way!

Tackle Your Credit Card Debt With 0% Interest Until Nearly 2027 AND Earn 5% Cash Back

Some credit cards can help you get out of debt faster with a 0% intro APR on balance transfers. Transfer your balance, pay it down interest-free, and save money. FinanceBuzz reviewed top cards and found the best options—one even offers 0% APR into 2027 + 5% cash back!

Until next time,

Steve B

Founder, The Daily Impulse

Important Disclaimer:

This newsletter is for educational purposes only and does not offer financial or investment advice. It should not be taken as a recommendation to trade assets or make any financial decisions. Please be cautious and ensure you conduct thorough research or consult with a financial professional before making any investment choices.

Third-party websites are for your convenience and informational purposes only. Please note that we have no control over the content, policies, or practices of any third-party sites. We recommend reviewing the terms and privacy policies of any third-party sites you visit.